Are you completely new to dental insurance? Are you clueless about the difference between prosthodontics and periodontics? If that’s the case, I’d recommend you visit the previous three parts on dental benefits basics, which you can find here:

- Part 1: 5 Considerations (Beyond Network & Price) When Buying Group Dental Plans

- Part 2: The Beginner’s Guide to Group Dental Insurance

- Part 3: What Is A Dental Network and Why Should You Care?

But if you already know the basics and would like to learn even more, then read on!

Just a warning: this post gets into topics that some people would consider “advanced,” but I like to think I’ve made everything simple and straightforward.

Waiting Period

Let’s start by defining “waiting period,” a common term you’ll run across in most dental plans, and one that often leads to confusion and skepticism. Many dental plans include waiting periods of some kind, but they can vary in terms of length and services they affect. Basically, a waiting period is a given length of time that a member needs to be enrolled before they can take advantage of a certain part of their dental plan.

For example, let’s say you enroll in a dental plan that has no waiting periods on diagnostic and preventative, a three-month waiting period on basic services, and a six-month waiting period on major services. (For your sake, I hope you’re not considering a plan that’s this complex, but stay with me for this illustrative example.)

Let’s say your effective date is January 1st. You could go to the dentist for diagnostic and preventative care and take advantage of the plan’s coverage on New Year’s Day (good luck finding a dentist that’s open, though!). However, if you need care for basic services, you won’t be able to take advantage of the plan until April 1st, three months after the effective date. For any major services, this would increase to six months, or July 1st.

Something to keep in mind is that many plans will waive waiting periods if you’ve been covered by another plan for at least a year. So if you’re looking to switch plans, breathe a sigh of relief because there’s a good chance that waiting periods don’t apply to you at all!

Age Limits

Also, let’s talk about age limits. The bad news is that some services are only available to people under a certain age. The good news is that the majority of services don’t have age limits at all. Actually, there are only a few places where age limits typically apply.

The first is orthodontics. Orthodontics usually have an age limit of 19 — this means if you’re over 19 and need orthodontic services, you can still receive treatment, but the costs won’t be covered by your insurance plan.

The only other services that commonly have an age limit are fluoride treatment and sealants, which are typically covered until age 14.

OK, that was simple enough, right? Now let’s jump into something a bit more complex. As promised, I’ll keep it straightforward and easy to understand.

Out-of-Network Coverage

Say you visit a dentist who is considered out-of-network on your insurance plan. Does that mean the cost of your visit won’t be covered at all? Thankfully, no. There’s more to the story than that.

First off, it helps to understand the difference between a PPO dentist and a non-participating dentist and why it matters:

- A PPO dentist belongs to one of an insurer’s networks of dental providers

- A non-participating dentist does not belong to one of an insurer’s networks

Simple, right? Here’s an example I discussed in a previous post. Let’s say XYZ Insurance partners with the ABC Network. If a dentist belongs to the ABC Network, they would be considered in-network for an XYZ Insurance dental plan. If they do not belong to the ABC network, they would be considered out-of-network. As far as why this matters, it mostly has to do with the percentage of the cost that your insurance will cover when you visit the dentist.

If the dentist is in-network, things are pretty simple. Your insurance plan will cover the listed percentage of the cost. If the plan says X-rays are covered at 100%, you pay nothing as long as your deductible has been met and your maximum has not (deductibles are often waived for preventative and diagnostic services, so the deductible wouldn’t apply if your X-rays fall under this category). If the plan says fillings are covered at 80%, you pay 20% (again, provided the deductible has been met and the maximum has not). For out-of-network dentists, things get a little more complicated.

MAC vs. UCR

To make sense of how this works, you need to know whether you have a MAC or a UCR plan and understand the difference. MAC stands for Maximum Allowable Charge (and can sometimes be called a PPO Fee plan) and UCR stands for Usual, Customary, and Reasonable. Basically, these terms refer to the way that coverage is determined when you visit an out-of-network dentist.

Under a MAC plan, the reimbursement for services provided by an out-of-network dentist is capped at the Maximum Allowable Charge (MAC). For example, if you visit an out-of-network dentist who charges $150 for a cleaning (covered at 100%), but the MAC is set at $100, insurance will cover $100 and you will be responsible for the remaining $50.

Under a UCR plan, the limit on reimbursement is set based on the Usual, Customary, and Reasonable value for your geographic area. A UCR value is calculated for each dental procedure by tracking all the claims that have been submitted for a specific procedure within a particular geographic area. The UCR value is then set at a level where a certain percentage (usually 80 or 90%) of fees charged for that procedure in that area are less than the UCR value. I told you this would get complex, didn’t I?

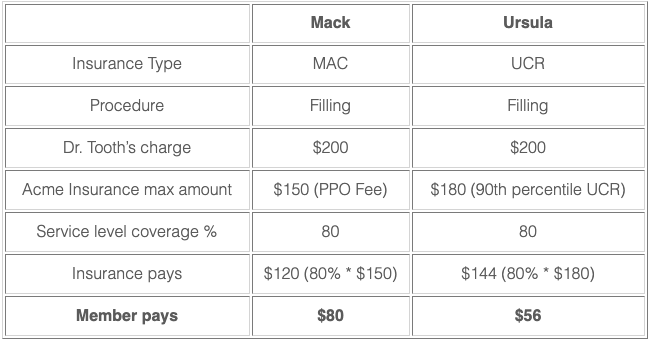

How about I try to simplify with an illustrative example: two fictional people, Mack and Ursula, have dental insurance plans with Acme Insurance. Say Mack and Ursula both need a filling and they decide to see the same dentist, Dr. Tooth, for the procedure. Dr. Tooth, being one of the best dentists in the area, charges $200 for a filling. Unfortunately, Dr. Tooth is not a part of the Acme network, so both Mack and Ursula are subject to out-of-network coverage. Let’s see what they’ll each owe.

First up is Mack’s appointment. Mack is enrolled in an Acme Insurance MAC plan, and under Mack’s MAC plan, fillings are covered at 80%. The PPO Fee for fillings on his plan is set at $150, so Acme Insurance will reimburse Mack $120 (80% * $150), and he will be responsible for paying Dr. Tooth the remaining $80.

Later that day, Ursula has her appointment. Ursula is also enrolled in an Acme Insurance plan, but hers is a UCR plan. The UCR percentile on her plan is set at 90%, which comes out to a UCR Value of $180 in her area. Dr. Tooth charges $200 for a filling, so Acme Insurance will cover $144 (80% * $180) and Ursula will cover the remaining $56.

In this example, Ursula owed less money to Dr. Tooth than Mack owed with his MAC plan. Does this mean that either option is better? Not necessarily. UCR plans are sometimes preferred in areas where the number of in-network dentists is low or if a group has a high number of members who see out-of-network dentists. A UCR plan guarantees that 80-90% of dentists in a geographic area charge less than the UCR Value for a certain procedure, so there’s a good chance that seeing an out-of-network dentist won’t be more expensive than seeing an in-network dentist. MAC plans are typically more affordable, but their fee schedule means it’s more likely that seeing an out-of-network dentist could be more expensive than seeing an in-network dentist. So, they’re usually a better choice for groups in areas with larger numbers of in-network dentists and whose members are already patients of in-network dentists.

Whew! That was a lot to take in! This should (hopefully) clear up some of the most confusing points. But if you’re still feeling a little lost, or just curious to learn more, you can check out the other posts at the beginning of this one! You can also read even more about MAC vs. UCR here!